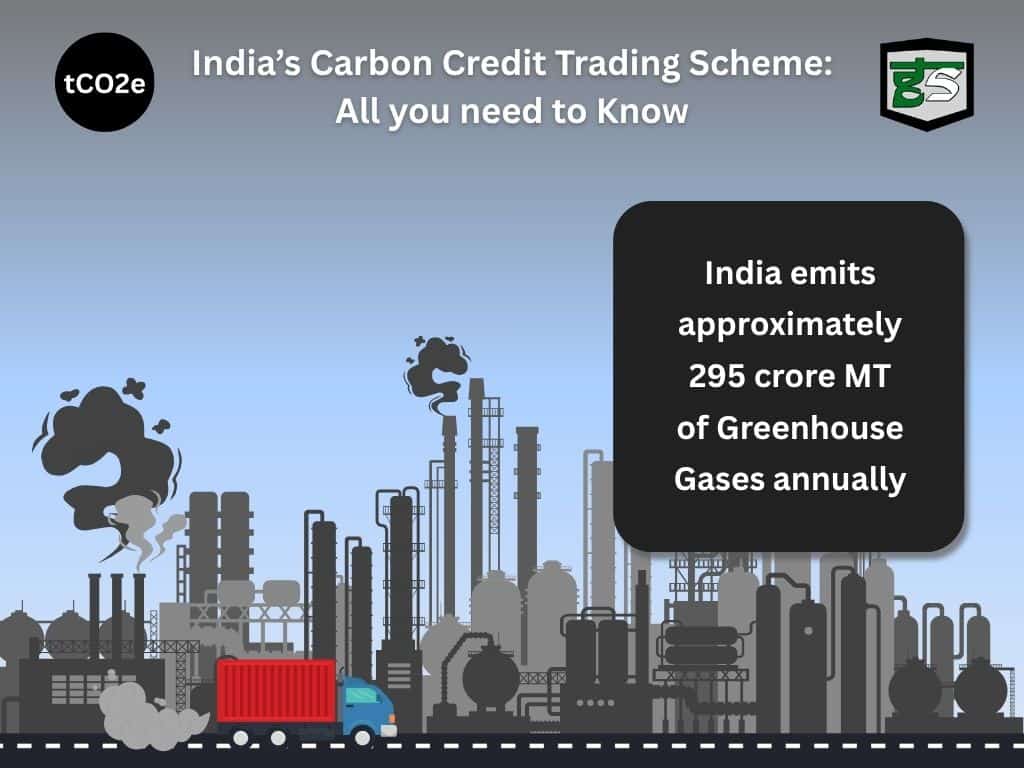

India emits approximately 295 crore MT of Greenhouse Gases annually.

The Carbon Credit Trading Scheme has been notified on 28th June 2023 under the Energy Conservation (Amendment) Act, 2022 to facilitate the development of carbon market in India. The registration under the same has begun from January 1, 2025.

What is Carbon Credit Trading Scheme (CCTS)?

Carbon Credit Trading Scheme (CCTS) is the scheme designed for reduction of carbon emissions notified by the Central Government. The scheme provides an approach to decarbonizing the Indian economy through a combination of mandatory compliance and voluntary offset mechanisms. This scheme allows verified carbon credits to be traded across sectors.

On 28th March 2025, the Central Government has approved 8 methodologies for the implementation of CCTS including Renewable energy, Green Hydrogen Production, Industrial Energy Efficiency, Landfill Methane Recovery, and Mangrove Afforestation & Reforestation.

What is a Carbon Credit?

Carbon Credit is a purchase unit which can be bought by any company, organization or a regular citizen to compensate for the carbon footprint they are generating or to support actions towards climate.

According to India’s notification, Carbon Credit is a tradable unit which can be generated by removal/ reduction or avoidance of one tonne of greenhouse gas emissions represented as Carbon Dioxide equivalent (CO2e).

Types of Carbon Credits:

Reduction Credit

The Carbon Credits generated by reducing or preventing greenhouse gas emissions from entering the atmosphere.

Removal Credit

The Carbon Credits generated by removing or sequestering greenhouse gases that are present in the atmosphere.

Greenhouse Gas Emissions that are represented as CO2:

The Global warming potential of a GHG is used to calculate their CO2e where GWP is a standardized value for each GHG that shows warming effect relative to CO2. This allows us to compare the climate impact of different GHGs in a single unit.

Tonnes of Carbon dioxide equivalent (tCO2e) is a standard unit to measure impact of Greenhouse gases on the climate.

Carbon dioxide (CO2), methane (CH4), nitrous oxide (N2O), hydrochlorofluorocarbons (HCFCs), hydrofluorocarbons (HFCs), perfluorocarbons (PFCs), and sulfur hexafluoride (SF6) are all greenhouse gases. As of date, only Carbon Dioxides (CO2) & Perfluorocarbons (PFCs) are covered under CCTS. Other Greenhouse Gases may be added in future.

How does CCTS help to reduce carbon footprint?

Carbon footprint is the physical measure of impact inflicted on the environment caused by an individual or organization. They are estimated based on consumption of energy and power.

The Carbon Credit Trading Scheme encourages companies to reduce/ remove greenhouse gas emissions which will in turn reduce the company’s carbon footprint.

What is Carbon pricing?

Types of Carbon Pricing Instruments:

Many countries have adapted carbon pricing using Emission Trading System (ETS) also known as Cap-and-Trade system, and Carbon Tax.

- Emission Trading System (ETS) is a scheme where limit is set on entity’s GHG emissions and entities are required to have allowances for each tonne of GHG emissions.

- Carbon Tax is a direct tax on the fossil fuel usage by an entity. It encourages to move away from carbon intensive production.

Carbon pricing at Global level:

Carbon pricing is implemented by many countries to control the GHG emissions. European Union (EU) had already adapted EU-ETS in 2003. Now, around 38 countries have implemented ETS including China, United Kingdom, South Korea, Japan, etc. ETS in 11 countries are under development and not fully implemented yet including India.

Carbon Pricing in India:

- India had implemented Perform, Achieve and Trade (PAT) in 2012. The objective of this scheme was to reduce energy consumption in energy intensive industries which will eventually lead to reduction in greenhouse gas emissions.

- India is now adapting a Carbon Credit Trading Scheme (CCTS) which primarily focuses on reduction/ removal of greenhouse gases emissions. Government of India has developed a detailed transition plan to smoothly shift from the Perform, Achieve, and Trade (PAT) scheme to the Carbon Credit Trading Scheme (CCTS).

- In CCTS, GHG emissions will be priced using rate-based Emission Trading System (ETS).

- As per the rate-based ETS, individual entities will be allocated a specific emission intensity target on their net GHG emissions above which they are required to buy Carbon Credits.

- As per the official guidelines, the entities who reduce their GHG emission intensity below the target GHG emission intensity can issue for Carbon Credit Certificates.

Significance of Carbon Credit Trading Scheme (CCTS):

- Environmental benefits: It is designed to reduce, remove and avoid Greenhouse Gases (GHG) emissions.

- Promoting Energy Efficiency: It will encourage energy efficiency by mobilising new mitigation opportunities to create demand for emission reduction credits through private and public entities.

- Commitment to Paris Agreement: CCTS will help India in its commitment to limit the global average temperature rise to below 2°C by the end of the century under Paris Agreement, 2016.

- India’s Nationally Determined Contributions (NDA): It helps India to achieve a part of its Nationally Determined Contributions of 45% reduction in GHG emission intensity by 2030 from 2005 GHG emission levels.

- Reduction in CBAM: According to CBAM Omnibus package notified on 23rd May 2025, the Carbon Credits bought in India under CCTS will compensate for the CBAM Tax in the European Union (EU).

- Helping India to become Carbon Neutral: CCTS ensures growth and development of the India towards net-zero by 2070.

Operating Procedure of Carbon Credit Trading Scheme:

- Nine sectors such as Aluminium, Chlor Alkali, Cement, Fertiliser, Iron & Steel, Pulp & Paper, Petrochemicals, Petroleum refinery, and textile are obligated under compliance mechanism of CCTS.

- The Carbon Credits are calculated using tonnes of greenhouse gases emissions in terms of tCO2e and Global Warming Potential (GWP) of the respective greenhouse gas.

- Carbon Credit certificates are awarded to a reduction or removal or avoidance of one tonne of CO2e.

- Surplus Carbon Credit Certificates can be “banked” for use in future compliance cycles or sold in the Indian Carbon Market.

- The obligated entities who are not able to achieve the target will be required to purchase equivalent number of certificates based on shortfall.

Gazette Notification for Carbon Credit Trading Scheme (CCTS) dated 28/06/2023

Loading...

Loading...